INTRODUCTION

Corporate finance is a function, which is used to deal with sources of funds and capital structure of various corporations. Managers take action to increase the monetary value of the company and enhance the interest of shareholders. Corporate financial management is the process of forming strategies and policies and making various investment decisions that improve the quality of the operations of the company (Aebi, Sabato, and Schmid, 2012). The main objective of corporate financial management is to increase the value of the stakeholders of the organization. It is used to set goals and make plans to attain them.

This project report consists capital market line and security market line, their importance, and graphical representation. The importance of minimum variance portfolios and capital assets pricing models are also covered in this report.

TASK 1

1 Comparison of security market line and capital market line

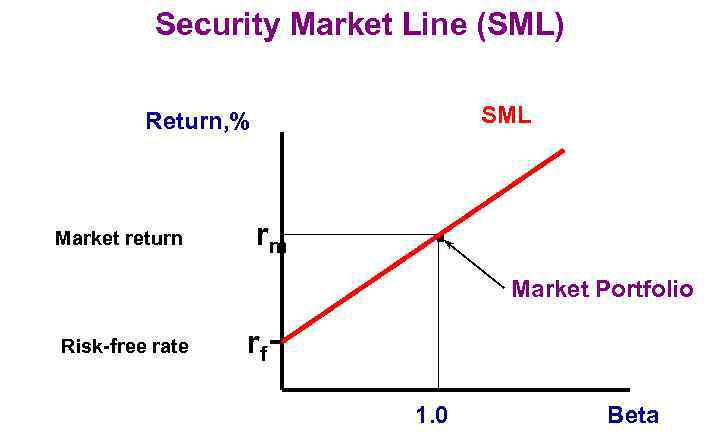

Security market line: It is an element that represents the risk and return of the capital asset pricing model. It demonstrates the relation between the expected rate of return and risk measured by beta. It is mainly drawn on a chart which is a graphical presentation of CAPM. The x-axis of the chart reflects the risk and the y-axis reflects the expected return. When it is used in portfolio management it reflects the opportunity cost of an investment (Baños-Caballero, García-Teruel and Martínez-Solano, 2014). It is a graphical representation of the market risk involved in an investment and its return in the future which is based on assumption.

Need to Consult Directly With Our Experts?

Contact UsBenefits of SML:

- It is an investment evaluation method that can reflect risk and return for the securities and it is mainly based on past assumptions.

- It can provide the forecasted idea to the investors about the risk and return on their securities for the future period.

- It is very important because it can provide information on efficient and inefficient portfolios.

- It helps the investor by facilitating his work while calculating the future value of a portfolio.

Here is a graph that can help to understand the concept of the Security Market Line easily:

Source: Security Market Line, 2018

The above graph reflects that the higher the risk higher the rate of market return, if there is no risk in the market then the holder of security is going to get a fixed percent of return which is called a risk-free rate. When the level of risk increases the return rate will also increase for that particular security. Here, Beta reflects the level of risk for the portfolios.

Capital market line: It is the straight line that is drawn from the point of risk-free assets to the executable area of risky assets. The conjunction point of this line represents the market portfolio of investors. This line is mainly concerned with the representation of risk-free assets and market portfolios. It is a graphical representation in which risk-free assets are represented by L and market portfolios are presented by M (Bender, 2013).

Benefits of CML:

- It shows the combination of risk-free and risky assets, which helps investors to choose the best portfolio.

- It only provides the idea of an efficient portfolio which saves the time of investors.

- The major benefit of CML is that the investor will be always up to date with the securities industry and have information on economic ups and downs.

CML can be understood easily with the help of the following graph:

Source: Capital Market Line, 2018

In the capital market line, there are various portfolios, and it is used to determine an efficient frontier from all the portfolios. In the above graph risk is represented by standard deviation, the chart reflects the efficient portfolio in which market risk and return are equal. Risk-free return is fixed for the portfolio holder. The curve reflects the risk and return of various portfolios and an efficient portfolio is the point where the investor can get an efficient return. So the investor can choose the option when the risk and return are proportionally equal.

Difference between SML and CML:

|

SML |

CML |

|

SML stands for security market line. |

CML stands for the capital market line. |

|

It represents return and risk measured by the beta of security. |

It represents risk-free assets and a market portfolio. |

|

The beta coefficient is used to measure the risk factor, that helps to find the security's risk contribution to the portfolio. |

Standard deviation measures the risk factor in CML. |

|

The graph of SML represents efficient and nonefficient portfolios. |

The graph of CML represents only efficient portfolios. |

|

All the security factors are determined by SML. |

Market portfolios and risk-free assets are determined by CML. |

|

The x-axis of the SML graph shows the risk which is represented by beta and the y-axis shows the return. |

The X-axis of CML shows the level of risk which is represented by the standard deviation and the Y-axis represents the expected return. |

The difference between SML and CML can be understood properly with the help of the following graphical representation:

_5deb7109209b4.jpg)

Source: SML v/s CML, 2014

TASK 2

2 Minimum variance portfolio and its importance

Minimum variance portfolio: It is a portfolio that is used to combine securities to minimize the activities of price movement of the whole portfolio. It indicates a well-diversified portfolio that consists of particularly risky assets. These assets are hedged when traded with each other and it results in lower risk for the expected rate of return on those assets. If there are constant changes in the price of securities, it will increase the possibility of higher risk. Hence if an investor is willing to minimize the risk they also want the ups and downs should be minimized for the security. Most of the minimum variance portfolios differentiate from a traditional mix of bonds and stocks. It is a mixture of highly volatile individual securities with low risk, rather than a mixture of low risk and high risk which is a combination of bonds and stocks (Brealey, Myers and Marcus, 2012).

Stuck with your Assignment?

Hire our PROFESSIONAL ASSIGNMENT WRITERS and Get 100% Original Document on any Topic to Secure A+ Grade

Get Assignment Help

Importance of minimum variance portfolio:

- It combines securities that help to minimize the constant price changes of the security.

- It helps to reduce the risk involved in the various assets by trading them with each other.

- It is different from the traditional portfolio, which is a combination of higher and lower risk of security, it only combines the securities with lower risks.

- Minimum variance portfolios provide a better risk-adjusted return on investment that increases the interest of investors.

- It is based on a weighted average method which helps to reduce the risk incurred in assets or securities.

- Investors wish to get quick returns on their securities, thus this portfolio helps them to increase their return and get a higher return quickly as compared to other securities (Brigham and Houston, 2012).

The minimum variance portfolio can be understood well with the help of the following example:

Example: The portfolio invests in five stocks with an allocation of 12%, 15%, 17%, 20% and 36%. Calculate the standard deviation and average of each stock:

|

Weights |

12% |

15% |

17% |

20% |

36% |

|

Year |

Stock A |

Stock B |

Stock C |

Stock D |

Stock E |

|

1 |

20.32% |

20.47% |

18.78% |

13.84% |

7.84% |

|

2 |

4.96% |

-5.68% |

1.23% |

-2.48% |

5.16% |

|

3 |

1.72% |

7.52% |

2.25% |

0.24% |

8.24% |

|

4 |

10.54% |

-3.76% |

3.45% |

-3.54% |

-2.47% |

|

5 |

1.85% |

-0.17% |

-4.49% |

-7.22% |

1.28% |

|

6 |

-4.23% |

-4.33% |

-8.25% |

-1.09% |

-4.06% |

|

7 |

-7.56% |

-8.55% |

6.52% |

-12.81% |

-0.36% |

|

8 |

-17.24% |

-4.26% |

11.56% |

-10.25% |

-18.36% |

|

9 |

27.89% |

18.79% |

13.15% |

17.25% |

14.18% |

|

Average |

4.25% |

2.23% |

4.91% |

-0.67% |

1.27% |

|

Standard deviation |

0.054 |

0.012 |

0.040 |

0.024 |

0.045 |

The average for each stock is 4.25%, 2.23%, 4.91%, -0.67%, and 1.27% for stock A to stock E respectively, and the standard deviation for each stock is 0.054, 0.012, 0.040, 0.024 and 0.045 for each stock for a year.

TASK 3

3 CAPM equation and its importance

Capital asset pricing model: It is a model that is used to find out an empirically suitable required rate of return on a security. This return helps the investor while making decision about adding assets to a well-varied portfolio. It was introduced by Jack Treynor, William F. Sharpe, John Linter, and Jan Mossin. The main function of the capital asset pricing model is to determine the relation between systematic risks and the expected rate of return on particular assets. It is used by large organizations in finance for the pricing of risky assets or securities, getting returns for assets, and calculating the cost of capital (Capital Asset Pricing Model, 2018).

Formula: Ra= Rrf + [Ba* (Rm- Rrf)]

Here,

Ra = Expected return on a security

Ref = Risk-free rate

Ba = Beta of the security

Rm = Expected return on market

Dividend growth model: It is mainly used to calculate the intrinsic value of a stock, which is based on current market conditions. It helps to calculate the fair value of assets, assuming that the dividends increase either at a stabilized rate or different rates during the period. It determines the value of stock whether it is overvalued or undervalued. It helps the investors to compare their security company to other companies (Higgins, 2012). It assumes various conditions such as the company's business model which is stable, if there are significant changes, the company's growth rate whether it is constant or not, the company's stable financial leverage, etc.

Formula: Value of stock = D1/ (k-g)

Here,

D1 = next year's expected annual dividend per share

K = The investor's discount rate or required rate of return

g = The expected dividend growth rate

Importance of Capital assets growth model: The capital assets growth model is more relevant while calculating the required rate of return as compared to the Dividend growth model. The importance of CAPM is described below, which reflects the relevancy of this model:

- It is sued when the investor is willing to grow its investment, it takes into account the risk of security in general and the risk of the company whose share is issued. Hence it helps the investor be aware of risk and helps them to invest in various companies so that if one company declines they can cover the return from another. This can give protection to their whole portfolio. But in the dividend growth model the investor will only have the idea of a dividend and the investor is only able to invest in one company if the company declines then the value of his security will also decline and an investor may have to face a loss. The divined growth model can only determine the financial health of the company and if the company can raise funds then dividends will be provided to the investors (Oikonomou, Brooks, and Pavelin, 2012).

- In the capital asset pricing model, the investor can reduce the possibility of risk, and determine the expected rate of return and if the market goes down, they still have a chance to get back their money. In the dividend growth model if a company goes down and faces a loss, in this situation the managers may decide to cut the dividend to cover the loss and the investor won't be able to get a return on their amount.

- In the capital asset pricing model the investor can make good and large returns for this the investor has to hold the security for the long term. It is also the same for the dividend growth model but the dividend will be received per quarter and if the investor is willing to get the dividend then he must hold the security for the whole quarter.

- Capital assets pricing model evaluates the risk and return involved in the security which is compared to the market average. The dividend growth model is based on the value of the dividend of a share (Wang and Sarkis, 2013).

It is clear from all the above-mentioned points that the capital asset pricing model is more relevant while calculating the required rate of return because while calculating the return from the CAPM method the investor must have the idea of return and risk involved in the security but in the second method the investor will only have the idea of return not the risk.

CONCLUSION

From the above project report, it has been concluded that corporate financial management is a process of evaluating and analyzing various sources of funds and the cost of its capital. Security and capital market lines are two methods that are used to evaluate efficient and inefficient portfolios. A minimum variance portfolio is used to minimize the risks of securities by combining various securities together. Capital asset pricing model is used to determine the expected return and risk which may affect the return on a particular security or asset.

Get help with Finance Assignment Writing Tasks from subject experts at the Assignment Desk at reasonable prices and unbelievable discounts.

REFERENCES

- Aebi, V., Sabato, G. and Schmid, M., 2012. Risk management, corporate governance, and bank performance in the financial crisis. Journal of Banking & Finance. 36(12). pp.3213-3226.

- Baños-Caballero, S., García-Teruel, P. J. and Martínez-Solano, P., 2014. Working capital management, corporate performance, and financial constraints. Journal of Business Research. 67(3). pp.332-338.

- Bender, R., 2013. Corporate financial strategy. Routledge.

- Brealey, R. A., Myers, S. C. and Marcus, A. J., 2012. Fundamentals of corporate finance. McGraw-Hill/Irwin,

- Brigham, E. F. and Houston, J. F., 2012. Fundamentals of financial management. Cengage Learning.

- Higgins, R. C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

- Oikonomou, I., Brooks, C. and Pavelin, S., 2012. The impact of corporate social performance on financial risk and utility: A longitudinal analysis. Financial Management. 41(2). pp.483-515.

- Wang, Z. and Sarkis, J., 2013. Investigating the relationship of sustainable supply chain management with corporate financial performance. International Journal of Productivity and Performance Management. 62(8). pp.871-888.

- Online:

- Capital Asset Pricing Model. 2018. [Online]. Available through:

<https://study.com/academy/lesson/capital-asset-pricing-model-capm-definition-formula-advantages-example.html>

Company

Company